In addition to the drive concept, rechargeable battery technology will be one of the core competencies of the automotive industry in the future. Europe must therefore ensure that it has its own battery manufacturing expertise and capacity. With the support of policymakers, major investments are currently being made to develop battery cell production. But how can European suppliers compete with Asian companies in this area?

Researchers at Markets and Markets expect global demand for lithium batteries for electric vehicles to grow 19 percent annually over the next five years. Accordingly, turnover is projected to grow from USD 56.4 billion in 2022 to USD 134.6 billion by 2027. The focus is expected to be on the 50 to 110 kWh battery capacity segment.

Until now, the leading suppliers have come from China, South Korea and Japan. In the first half of 2023, CATL accounted for more than one-third of the global market for rechargeable batteries for electric cars, while BYD moved into second place with just under 16 percent, ahead of LG Energy Solution with 14.5 percent. Battery heavyweights such as Panasonic, SK On, CALB and Samsung SDI follow with single-digit percentages. The top five manufacturers alone account for more than three-quarters of the global market. It is not uncommon for their production facilities to be built by large project developers as turnkey solutions.

Turnkey providers at an advantage?

These so-called turnkey providers have extensive experience. As project developers, they offer all the necessary expertise under one roof, which reduces the need for coordination. They use proven technology and offer to create clones of equivalent Asian production facilities in Europe - in a comparatively short time.

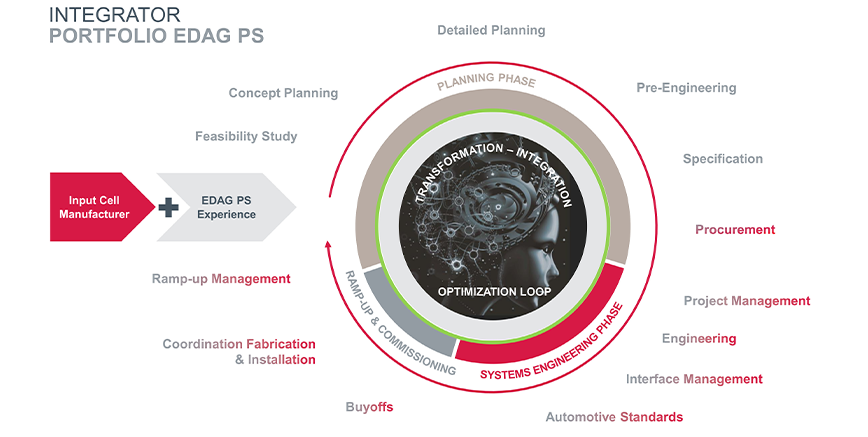

In Europe, there are simply no providers of a similar size that can offer everything from a single source. In the best case scenario, alternatives can be presented using an integrated approach. For physical construction and the start of industrial production, a range of skills are required, including project development, industry-specific features and process engineering elements. These need to be brought together in a dedicated consortium. The key steps of such a project include:

- Establishment of a central project management team to coordinate consortium members and tasks

- Feasibility study, conceptual planning, detailed planning and equipment specification through to "translation" into the appropriate tender documents

- Plant construction

- Accompanying the installation of the equipment in the production facility

- Commissioning

- Plant ramp-up including troubleshooting and optimization measures

Linking these together takes time and effort, as they have tended to be individual solutions. This can have a negative impact on competitiveness: The investment costs (CAPEX) will be higher than for a turnkey solution. At least from this point of view, Asian providers have an advantage.

Consideration of detailed aspects

One relevant aspect is the high rate of development of battery cell technology. Today, lithium-ion batteries in the form of pouch, round or prismatic cells are common, but new formats, dimensions or materials could soon become relevant, for example solid-state cells. To make a production plant fit for the future, it must be flexible and adaptable.

State-of-the-art digitalization, which includes the use of the digital twin and other common digital tools, for example, is essential for such flexibility. For one thing, a digital image of the plant makes it easier to adapt production, since the effects of a new product on the plant can be tested virtually in the early planning stages - and the physical implementation only takes place once all the problems have been solved in simulation. This can also be used later during commissioning, servicing and maintenance. However, it also requires the right digital transformation skills. Start-ups, in particular, often need support in this area.

Another point is sustainability in production. Large numbers of vehicle batteries will soon be available for reuse and recycling. The EU has already issued regulations on the use of recycled materials, but also on the CO2 footprint of production. These - and possibly other restrictions - must be considered when setting up a new production facility.

Last but not least, the operating costs determine the competitiveness of a European production solution compared to those of Asian suppliers with lower investment costs. Better OPEX values, such as significantly lower reject rates or higher throughput, can shift the total cost of ownership (TCO) in favor of an integrated solution, despite higher raw material and energy costs in Europe.

Total costs are decisive

In fact, turnkey solutions often have weaknesses that get in the way of efficient operation. Operators struggle with throughput issues and high reject rates. Issues such as CE marking and other European standards, for example on occupational health and safety, are also a major challenge for project developers based outside the EU, and are not always resolved to the customer's satisfaction. They then have to perform time-consuming rework, which both erodes the time advantage and drives up the cost of the initial investment.

A combination of European specialists, whether in the form of a consortium, joint venture or similar construct, therefore offers opportunities to survive in the seemingly hopeless competition with the industry giants by means of economically attractive solutions. To be competitive, the European industry needs systems that are powerful and highly efficient, produce advanced cells, and can be flexibly adapted to the dynamic technological development in this field.

There are many qualified providers with expertise and sustainable solutions in their respective fields. For example, the Battery Atlas provides an overview of relevant manufacturers at all stages of the value chain. Meta-Market-Monitoring by Fraunhofer ISI provides further market data along a global value chain for lithium-ion batteries.

Coordination responsibility with expertise

The question is who can coordinate and manage such a cooperative endeavor. This requires both general production skills and specific knowledge of the unique features of battery manufacturing. EDAG can take on this task and also become active itself in various areas. EDAG Production Solutions (EDAG PS) offers 360° production engineering, including plant planning and optimization, digitalization of processes and experience in simulation and virtual commissioning.

Moreover, the EDAG Group is involved in various committees and consortia for battery cell production, such as FestBatt (Anselm Lorenzoni) and ProZell (Anselm Lorenzoni), so that it can also draw on industry knowledge in this area. This combined expertise is complemented by extensive industry contacts with companies at all levels of the value chain.

Are you also involved in battery cell production and looking for support or a partner? Then talk to Martin Völker, Senior Project Manager in the Automotive Solutions division of the EDAG Group, or download the white paper "On the way to European battery cell production", which describes the challenges of setting up your own production and shows how such a project can be successfully implemented.